what is a fit deduction on paycheck

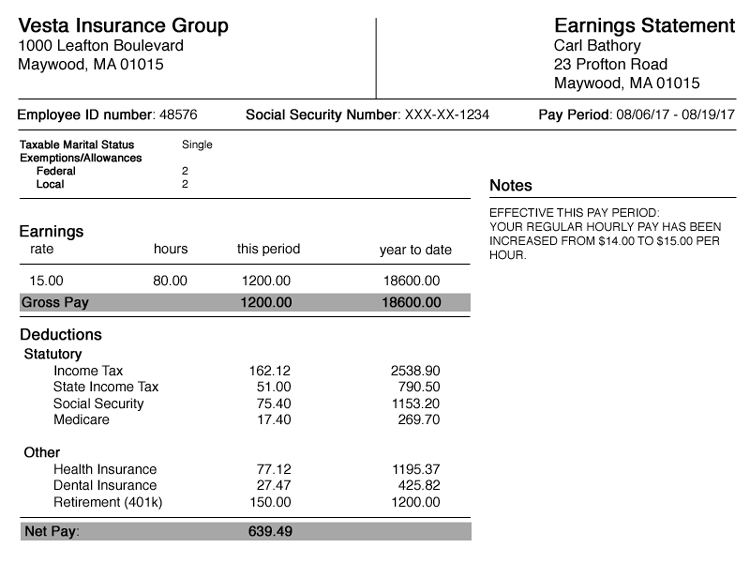

3 3PDF Deduction Gross pay State income tax SIT. FIT is the amount required by law for employers to withhold from wages to pay taxes.

How To Calculate Payroll Taxes Tips For Small Business Owners Article

Deducted amounts can include taxes insurance.

. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Your goal in this process is to get from the gross pay amount gross pay is the actual amount you owe the employee to net pay the amount of the employees paycheck. FIT or Federal Income Tax witheld is deducted from pay along with Social Security Tax on Wages Medicare Tax and other deductions.

Going beyond federal state and FICA taxes your paycheck may be lower if youve made contributions toward a health savings account HSA or if you pay any premiums for an. If you see the fit deduction listed on your paychecks earning statement it is an acronym for federal income tax. Its the amount your employer deducts from your earnings each pay period and remits to the IRS on your behalf.

This amount is based on information. The FIT deduction on your paycheck represents the federal tax withholding from your gross income. What is fit deduction on my paycheck.

What does fit stand for in the payroll deduction process. What is the fit tax rate for 2020. Fit represents the deduction from your gross salary to pay federal withholding also known as income taxes.

There are a few things you should know about fit deduction on your paycheck. Fit deductions are typically one of the largest deductions on an earnings. FIT deductions are typically one of the largest deductions on an earnings.

2 2Federal income tax FIT withholding Gusto Help Center. FICA taxes support Social Security and Medicare. Subtract all deduxtions to get your Net Income.

37 for incomes over 518400 for. Your income tax rate is dependent on the amount of taxable income you earn because federal income tax is built on a progressive tax system. It covers two types of costs when you get to a retirement age.

FIT deductions are typically one of the largest deductions on an. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. What it is and how it affects wages and withholding.

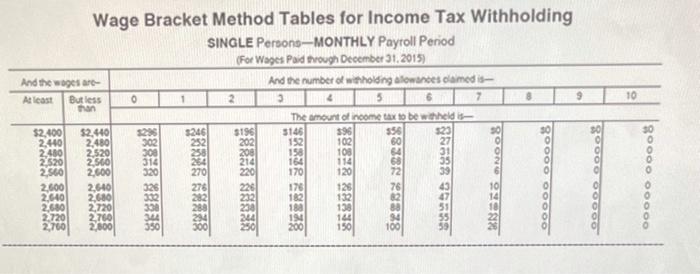

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Employees pay Social Security tax at a rate of 62 with a wage-based contribution limit and they pay Medicare tax at 145 without any. To calculate federal income tax withholding you will need.

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Its based on an estimation of what you think youll owe at the. Deductions are the paycheck items youre probably most familiar with because they take away from your earnings.

This money is a pre-tax payroll deduction meaning that whatever amount you choose to contribute from each paycheck is deducted from your total taxable income. The federal income tax rates remain. In a payroll period the taxes deducted from a paycheck typically include Social Security and Medicare taxes otherwise known as FICA Federal Insurance Contributions Act.

First fit deduction is an IRS Tax Code feature that allows you to deduct the cost of wearable.

Take Home Pay The Deductions Taken Out Of Your Paycheck Help Support Schools Roads National Parks And More Why Do You Think You Have To Pay Taxes Ppt Download

What S In A Paycheck Employer And Employee Responsibilities

Workplace Basics Understanding Your Pay Benefits And Paycheck

Solved Assume A Tax Rate Of 6 2 On 118 500 For Social Security And 1 45 Course Hero

How To Read A Pay Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

How To Make Sense Of Your Pay Stub

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

Your Paycheck Tax Withholdings And Payroll Deductions Explained

Calculating Federal Income Tax On Form 1040 2014 Ppt Video Online Download

How Much Of My Paycheck Goes To Taxes

How Much Does Government Take From My Paycheck Federal Paycheck Deductions

How To Calculate Federal Income Tax

2022 Federal State Payroll Tax Rates For Employers

How To Read A Paycheck Or Pay Stub

Understanding Your Paycheck Credit Com

Recording Payroll And Payroll Taxes In The Journal Youtube

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

Understanding What S On Your Paycheck Xcelhr

Solved Find The Fit For Each Paycheck Using The Tables Chegg Com